Are you currently in debt? If you are, you probably know how difficult it can be and how easily debt can get the best of you. You may be asking yourself the same question: “How do I pay off debt with no money?

You’re not alone.

Every week, we get emails from people all over the United States and other countries who are in difficult financial situations and some of them even in desperate situations.

Many of our readers have unneeded anxiety and stress because of their debt. They feel confined because there will not be available cash to work with.

No available cash can make their situations seem impossible.

But hang on to your seats because I have some great news: It is totally possible to pay off debt with no money!

In fact, many of my Flipper University course members start flipping with no money to start and end up making some pretty crazy cash!

Yes, you heard that right! They start out with no money, but in no time they can turn nothing into hundreds or even thousands of dollars.

Want Proof?

Check out what our Flipper U students have been able to accomplish!

- Stacy took $0.50 and turned it into $20K in 15 months

- Kelly sold an old vacuum in her basement and made $400

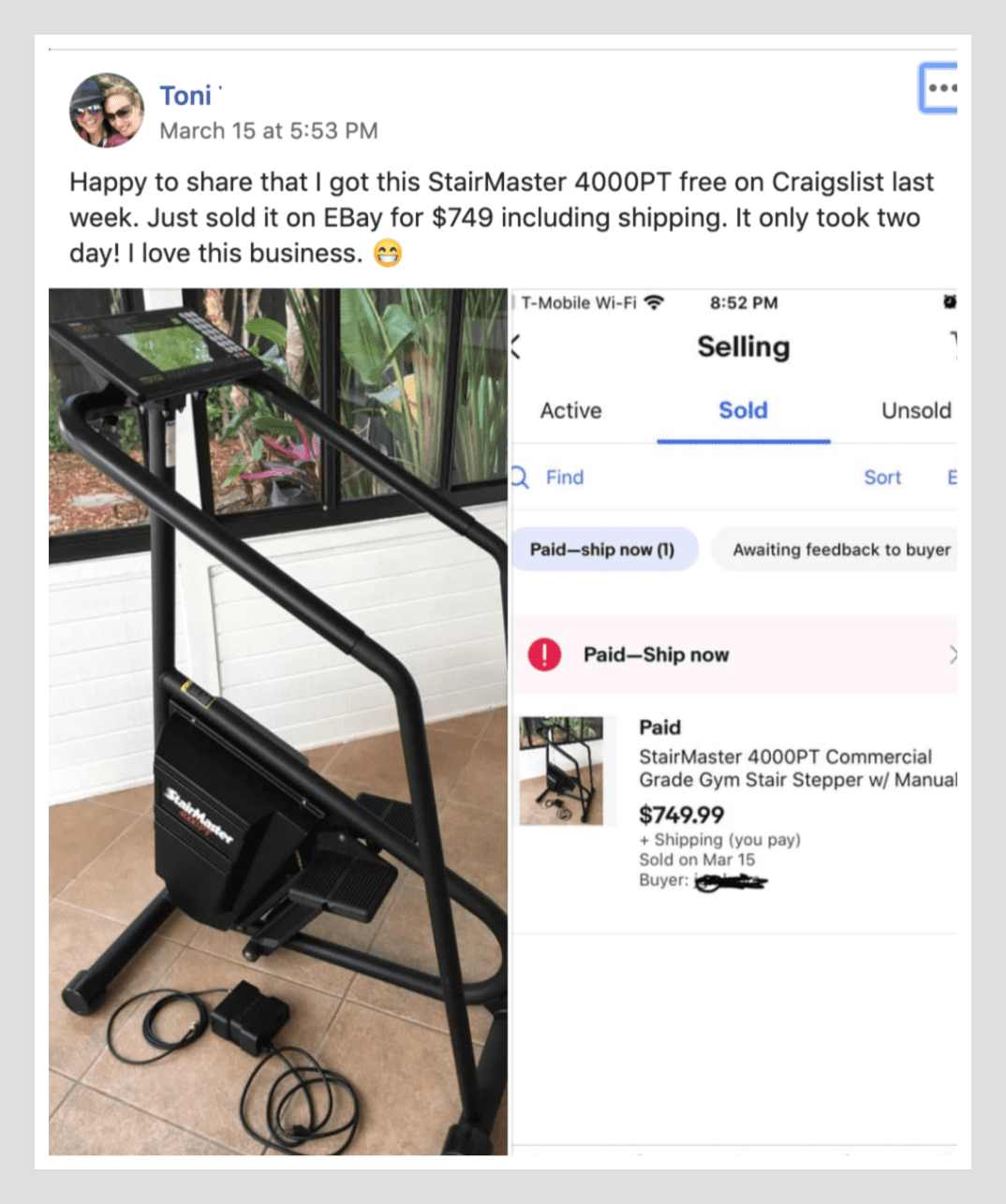

- Toni picked up a free exercise machine and sold it for $750 in 2 days

- Marion got a free pair of shoes from a client and sold them for $95

And the list goes on and on!

How to Pay off Debt with No Money:

So how do you pay off debt with you money? This is a question you may be pondering as you find yourself in a sticky financial situation and I’m to tell you that it is entirely possible for you to start flipping items for profit and you don’t need one penny to your name.

Today, I am going to share with you four ways you can start to earn some extra money TODAY without having money. I also have included four tips for making a plan to use that money to get out of debt fast.! Because we always need a plan right?

Let’s get started!

- Sell Your Unused Stuff

- Sell Other People’s Cast Offs

- Pick Up Free Items From Online Selling Apps

- Dumpster Dive

Make Money by Selling Your Unused Stuff:

Let’s face it, as Americans we have way too much stuff and I often times struggle with having too much stuff because I do this gig full-time. We just accumulate too many things that we don’t use or don’t need.

For example, I bet if you looked around your house, I’m certain you could find several things in your home that you haven’t been using for a while.

Just because you aren’t using them anymore doesn’t mean someone else won’t pay you for it so they can use it! Take a look around your garage, bedroom, closets, and kitchen for items that you haven’t used for some time.

The rule in our house is if we haven’t used it in a year, it’s time to get rid of it.

Snap a few photos of your items and post them on free sites like Facebook marketplace and Offerup so you can sell them and make some money by the end of the day.

You absolutely do not need any money to make money because flipping allows you to start with nothing! It’s a great and low risk way to recoup some money you’ve spent on items that you are no longer using.

This is new money to work with and because it’s money you didn’t have yesterday, today you can start paying off your debt.

Sell Other People’s Cast Offs:

For a long time, we never told people what we did for a living. Looking back, I’m not sure why we kept that a secret.

We didn’t share with others and never posted anything on social media about what we did for a living. But over the last few years, we decided why not? We love what we do and love sharing about it to others.

Since we started sharing about what we do for a living, you would not believe the doors this has opened for us. People have given us so many quality items to sell that they no longer wanted.

We have also taught our course members to do the same. Marion, one of our Flipper U students, cleans houses for a living. She told all of her clients what she was doing and she has literally got hundreds of dollars worth of designer shoes and clothing to sell that her clients were getting rid of.

Just telling people what we do has given us hundreds of dollars that we wouldn’t have had and it won’t cost us a dime. We have been able to make money with no money by just telling others and you can too!

If you want to pay off your debt quickly with no money, let other people know you are flipping items to pay down your debt. Watch how many items end up coming your way.

Sell Free Items From Online Selling Apps:

Have you ever tried typing in “free” into Offerup or Facebook marketplace? Try it! It won’t disappoint. You will find hundreds of free items that are sitting on someone’s curb or next to a moving truck to be picked up instead of being dumped in a landfill.

A few years ago, I responded to an Offerup ad for two perfectly working Skidoos. When I went to go look at them, the guy said he just wanted to give them to me! That’s right. He gave them to me for free!

I took them and used them for a year and had a blast with my family playing with them on the water. The next year, I sold them for $1200! Free money everywhere and you can get your hands on it too.

Why not take those free items and resell them? This is a great way to get cash without putting out any money of your own. This is extra money you wouldn’t have that can be a valuable part of your debt free journey.

Dumpster Dive:

Now I don’t go out of my way to jump inside a dumpster every day just to find free stuff. However, I do take walks to my downtown area every evening, especially on large trash days and I find the best free flips!

One evening on our walk, we found a beautiful wooden headboard on the side of the road for trash day. We couldn’t believe they were throwing it out because it was awesome!

We posted it and sold it on Facebook marketplace two days later for $150.

How would it be if you got in the habit of looking for free items on the side of the street or sitting next to a dumpster? You could get some free cash to get yourself out of debt much quicker and believe me, there is no shortage of flips you could get your hands on if you kept your eyes open for them.

People throw away so many valuable things. Why just let it go to a landfill somewhere? You can pay off your debt with that money as there are free items everywhere. The dumpster is no exception!

So there you have it – four great ways you can pay off debt with no money! It’s so easy to do.

So now you are well on your way to paying off debt with no money, but now what?

Things You Can Do to Start Paying Off Debt:

- Make a Budget

- Save a Small Emergency Fund

- Start the Debt Snowball Method

- Cut Up Your Credit Cards

If you want to make paying off your debt with no money a reality, you will need to make a few changes. If you don’t make a plan and change how you do things, you will put the free money in your pocket and spend it on something else.

You want to pay off your debt right? So here are some practical steps to take to dump your debt for good. If you want a great book to help you get started, Dave Ramsey’s book, Total Money Makeover, comes highly recommended!

Make a Budget:

Now you might be thinking that a budget sounds too confining, but honestly it’s not. I do admit I have a hard time with my own budget and believe me, Melissa is much better at budgets than I am. It’s not my favorite thing. But together we have a plan that works and we help hold each other accountable.

Statistics show the best way to accelerate getting out of debt is to tell your money where to go. That’s what a budget will do for you. Figure out all of the money that you have coming in and going out and make a plan for it.

In short, see where you can find extra money in your budget and throw it towards your debt because every bit of extra money you find from flipping your free items will help you pay down your debt even faster.

If you make a budget and have a money plan, you will know exactly where you are going!

Save a Small Emergency Fund:

Dave Ramsey recommends $1000 emergency fund. It’s a small fund to keep small emergencies away so you don’t derail your debt reduction. This small amount of money should be saved for nothing other than an actual emergency!

What an emergency is not? It’s not used for a surprise vacation or furniture for your living room! It’s only used for actual emergencies like your water heater broke or your car needs a repair, etc. This is just a small way to keep you covered until you can kick your debt and start really saving money.

Go find some free stuff and put a few photos on Facebook to get the $1000 as fast as you can. This will get you prepared to start getting rid of the debt.

Start the Debt Snowball Method:

This is the method that makes the most sense. How does it work?

Make a list of all of your debts and start paying them off from lowest to highest. Dave Ramsey recommends lowest to highest because it will give you some quick wins.

I like quick wins – it helps motivate me to keep going!

Let’s face it, paying off debt really for lack of a better word sucks! Honestly, I’d much rather take a cruise or a vacation somewhere than pay my debt! But if I want to take that great vacation, I realize it’s necessary to have my debt paid off!

When you get your first debt paid off, add the amount of that payment to your next debt and so on. This will definitely give you the snowball effect and your debt will go away fast if you stay focused.

Go out and create some extra income by flipping some free items using the tools I taught above. This will give you some extra cash without using a penny of your own money.

You can use this to pay extra on your debts to get rid of them even faster. Turn no money into cash? Absolutely!

If you want some motivation, read Chris and Jessica’s story on how they managed to to pay off $65K in debt in 14 months starting with just $20!

Stop Carrying Credit Card Debt:

Once you start your debt snowball, however, be sure to either cut up your credit cards or use them responsibly by paying off the balance each month.

Because most Americans have credit card debt, the high interest rates can rapidly increase their balances. Therefore, this increase in debt can equal trouble for a lot of Americans.

In fact, credit card debt is the highest debt that married couples have.

At 21% interest or more, it’s not a good financial plan to carry debt on your cards. They can get out of control and cause some major problems adding debt.

You may be asking yourself, “Are there tricks to paying off credit card debt?” The answer? Nope, it’s just like anything other debt. You just have to stop the cycle of using credit cards, add the balance to your debt snowball, and pay them off!

Next, it’s good to make the decision to never have credit card balances again! Just that simple.

With your newfound success flipping free stuff for cash and a well thought out plan to apply that free money to your debt, you can be out of debt in no time!

Therefore, you can pay off your debt with flipping even if you have absolutely no money!

It is totally possible and it’s not as hard as it seems. Make the decision to start today by making a financial plan, flipping some free stuff, and kicking your debt for good! You’ve got this!

If you are struggling with debt and you would like to learn how to pay off debt with you money by flipping free items, check out our FREE Intro Workshop to find out more on flipping items!

Further Resources

Free 5-Day Intro To Flipping Video Course

FREE Workshop How To Turn Your Passion of Flipping Items Into A Profitable Reselling Business

Related Posts

How I Quit My Job To Flip Flea Market Stuff Full-Time

How This SAHM Made $1,000 In Her First Month Flipping Used Items

Finding Free Items To Flip: How This Couple Turned A FREE Item Into $1,299!

How This Family Used eBay To Crush $65,000 Of Debt In Only 14 Months!

How We Turned $100 Into $3,200 By Flipping Items While On Vacation