Ebay Tax Reporting: What Resellers Need To Know

Taxes.

Nobody loves the topic (ok, some people do – I’m not one of those people), but taxes are important to anyone who wants to earn an income.

Doing taxes as a small business can be a very daunting task when starting out. It’s one of the top road blocks that actually keeps people from getting started in this flipping business.

But it shouldn’t.

Once you have a basic understanding of the requirements, doing taxes as a reseller is not that scary.

Since we are not tax experts, we interviewed one to help us get some answers to commonly asked tax questions. We met tax expert Mark Tew with Not Your Dad’s CPA who specializes with taxes for resellers.

So without further delay, here is the interview:

Thanks so much for doing this interview Mark! Taxes tend to be one of the biggest road blocks for getting started with this side hustle. We want to help people better understand what they are required to do as a reseller so they can take off with their business/side gig.

So let’s dive in!

What is your background? How did you get started with helping resellers specifically?

I am a CPA and started doing public accounting. But then I decided to try doing some taxes for people on the side to see if it was something I would like to do and ended up working with a lot of eBay and Amazon sellers.

The I started reselling on Amazon as a side hustle myself. (See everyone needs a side hustle!)

That led me to learning more about the reselling business and naturally I gravitated to helping resellers with their taxes.

Do I need an LLC to start selling on eBay?

It depends on your goals, but you don’t have to have an LLC to get started on eBay.

Right when you get started selling you become a Sole Proprietorship. There are no forms to fill out for it, you are one by default. The IRS now considers you as a business.

Eventually an LLC may make sense, but it’s not going to affect a lot in your business tax wise.

An LLC is there to help protect your liabilities under a business instead of personal, and if you are just selling household items when getting started, you don’t really need one from day 1.

Don’t let getting an LLC stop you from getting started.

Ebay issues a 1099 after $20K sales, so if I’m under that do I have to keep track of my sales?

This is a common misconception.

Sellers think that they don’t have to file because they didn’t get a 1099. Or they try to sell just under the threshold to receive one.

Unfortunately, even if you don’t get that 1099 because you are below the threshold, you are still required to report and pay tax on any profit you are generating in your business.

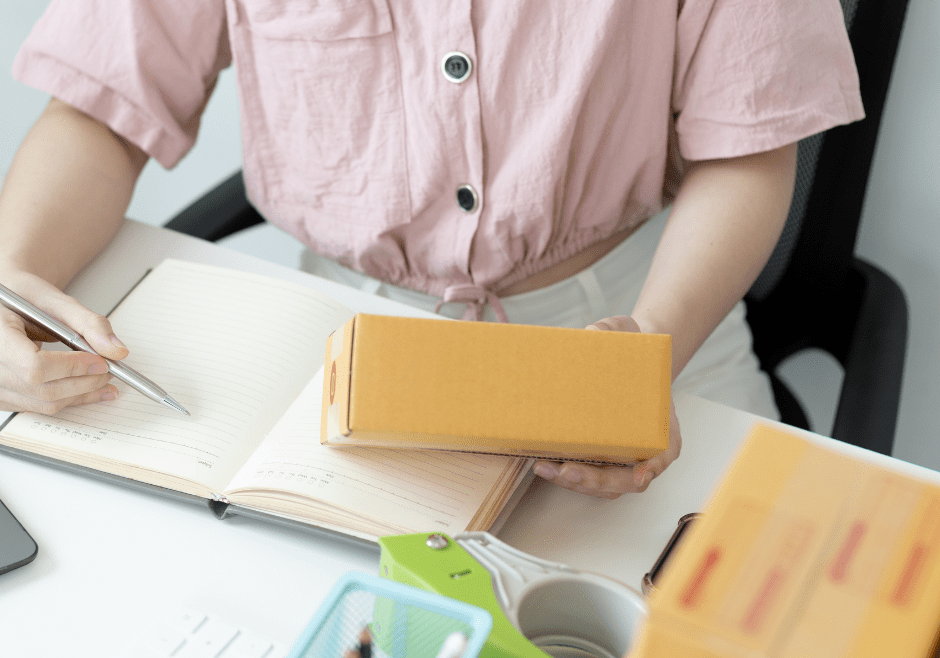

Is there a specific way you have to do bookkeeping?

No, the biggest thing is you have to keep track of your records somehow.

That could be in a spreadsheet, or could be a simple bookkeeping program, or a more robust bookkeeping program like Quickbooks.

The biggest thing is you want to be sure you are separating out business income and expenses from personal.

Since eBay’s Managed Payments eBay is asking for my social. Do I need to provide this? Why?

Now eBay is taking the place of PayPal as the payment processor.

They are required by the IRS to send you a 1099 if you are above a certain threshold. So they have to get that tax information from you.

Can you get an EIN for your reselling business?

Yes, as a sole proprietor, and EIN is optional. So it could be an option if you don’t want to give your social.

If I sell my own stuff on eBay, do I have to track that?

That one depends.

Alot of times when you sell your own personal stuff you are selling it for less than you purchased it for, which means you are actually generating a loss.

When you have a loss you don’t have to report that on your income for taxes because you aren’t going to owe any tax.

If you generate a profit you should report it.

But either way I encourage people to report it because if you have a loss, it’s only going to benefit you on your taxes.

It’s going to offset some of your taxable income and reduce your taxes overall.

What are some write offs I can use as a reseller?

Typically most things you purchase to use for your business are going to be deductible or at least partially deductible.

The normal things you buy like shipping supplies, software subscriptions, inventory, business portion of internet or cell phone that you use.

Business mileage to the post office or going to pick up items. (You can deduct round trip).

You can also deduct any business meeting meals or meals while traveling for business.

Basically keep track of every business expense because you can likely deduct it.

What’s the best way to keep track of mileage used for business?

There are so many apps out there.

MileIQ is super easy to use. You just mark the the trip as business or personal and it records it.

Do I have to file sales tax with my state?

In most states now, resellers don’t have to worry about it.

The platform they are selling on is required to remit sales tax for you because of what’s called Marketplace Facilitator Laws. And most states have these in place now.

There are just a few stragglers right now (like where we are in Florida).

So if you are in one of those states you have to report and pay your sales tax quarterly.

You can check Avalara’s state by state guide to see if your state has adopted marketplace facilitator laws yet or not.

Thank you so much Mark for answering our tax questions!

If you are interested in diving further into getting your reselling business ready for tax season, Mark has an awesome course called Reseller Tax Academy.

It’s all about helping you optimize your business situation for taxes so you can reduce the anxiety that goes along with getting ready for tax season.

You can check out his Reseller Tax Academy here. ( & he’s given a $50 Off coupon for our readers! Use the code FLEAMARKETFLIPPER)

You can also check Mark out on his YouTube Channel or on Instagram.

FURTHER RESOURCES

$1 Flip Club Challenge – Turn $1 Into $100 In 7 days

FREE Workshop How To Turn Your Passion of Flipping Items Into A Profitable Reselling Business

RELATED POSTS

How This Mom Of 6 Turned $.50 Into $100K By Flipping Items

How We Made $16K In One Month Of Flipping Used Items

This post may contain affiliate links. Please check out our affiliate disclosure for more information.