This post contains affiliate links, please see our full affiliate disclosure for more info.

Switched over to eBay managed payments but still want to keep your eBay business income separate? But there are so many options out there, how do you choose the best bank for you to use with ebay’s managed payments?

We got you!

We wanted to keep our eBay business accounting separated from our personal bank account so we looked into several different options once Paypal was no longer an option.

And when I mean we looked into them, we signed up for a few of them before realizing they weren’t a great fit and I’m pretty sure our credit took a hit for it.

But it was still worth it to check them out so we could share what we’ve found with YOU!

I want to give you some of the pros and cons of each account so you can decide what’s best for you. (And also share with you what we decided to go with!)

But before we jump in, do you even really need an extra bank account?

Yes & No.

You could use your own personal bank account and have eBay do a direct deposit, but that’s not something we advise.

Even if you are just doing this as a small side hustle, we still recommend a separate account because it’s so much easier for accounting purposes!

And yes, even if you are doing this as a small side hustle you should still keep records of what you are making – and you are still responsible to report taxes on them

You can read more on reseller taxes here.

So let’s dive in!

Azlo Is A Bust

When we found out we were being switched over to managed payments last fall, I started looking into different options for separate bank accounts. Before when we had Paypal, it was no problem. We used Paypal as a separate account and it was great for keeping track of all of our tax details throughout the year.

All that changed with Managed Payments.

After listening to a podcast one morning on our run I heard a pitch for Azlo – an online banking account perfect for small businesses & entrepreneurs.

I signed up and it seemed really awesome! Something I would have totally wanted to recommend to you, but after 2 months in, they were bought out by another company and were shutting down these types of accounts.

So Azlo is out. ☹

Up next is Qube…

Qube is a cool account because it comes with some budgeting tools that are pretty nifty. My wife Melissa does our budget and still prefers to do it on a spreadsheet so she didn’t want to switch to their tools. However, that doesn’t mean you can’t use these great tools for your own budgeting needs!

With that said, we were still interested in using Qube as an outside bank account for eBay.

And then we realized that they were a mobile app only and we couldn’t access our account on a laptop or desktop.

This was kind of a deal breaker because when Melissa is doing our Profit/Loss sheets and budget, she likes to work from the computer.

For us, this wasn’t going to work.

But if you are someone who does everything from your phone it could be an awesome fit for you.

Qube Pros

- Individual plans are free

- App is free and easy to use

- Several people (couples and families) can can connect to the same account

- Real-time financial monitoring

- FDIC insured

- Fraud protection available

Qube Cons

- Qube is not available outside the US

- It’s currently being beta tested (not yet finalized). That might mean there are still some bugs that need to be worked out.

- Accounts cost $8-15 if you want to use the app with your partner or kids

- Limited features with free accounts

- You must use Qube debit card

- No rewards available with the free option

- Only available on App currently (this may change in the future)

Betterment

Betterment is an interesting one. It has two sides to their offering and it’s pretty cool.

They offer banking services and also offer investing services.

We aren’t very savvy in the investing side of things (unless of course it’s investing in awesome inventory that’s going to 10x your money!) So we can’t speak a lot about investing. BUT Betterment seems to have a really cool ability to just be an extra business checking account, or also add an investing portfolio if you are interested.

Betterment Pros

- Solid 0.10% Betterment cash reserve

- No monthly checking fees

- ATM fees reimbursed worldwide

- FDIC insured through third party bank

- Debit Cards for checking accounts

- No foreign debit card fees

- No withdrawal Limits

- No overdraft fees

- Online banking available both desktop and mobile

- No account minimums

Betterment Cons

- Offers no interest for checking

- No branches

- No check deposits

- Limited Live Support hours and no live chat options

- No cash deposits

Capital One 360 Checking

CapitalOne has become a major player in the banking industry over the past several years. Everywhere you look, you will see them advertised.

Not only do they offer checking accounts and investing options, they have some of the most competitive travel rewards cards on the market.

They are a full-service bank and that includes online checking accounts.

And they have a lot to offer, including an interest bearing checking account, which is pretty rare when you are getting a free checking account.

Let’s take a look at the pros and cons of Capital 360 checking.

Capital One 360 Pros

- 24/7 Mobile Banking

- No fees to open, keep & use

- 70,000 fee-free ATMS around the country

- 0.10 APY for checking accounts

- Debit Card Lock & Unlock Features from App

- Deposit Money From App

- Receive real-time alerts about your account balance and activity

Capital One 360 Cons

- Limited Services at in-person branches

- Low interest on checking account

- Depositing checks from App is not fool-proof – still working out the bugs

- Few local branches for in-person services

Chase Business Checking

We’ve been long time customers of Chase for both their business and travel cards. We use Chase credit cards a lot for our everyday items so we can earn travel miles and points.

I want to include Chase because some people may weigh out the $15 fee per month in order to be able to go into a brick and mortar bank. Some may not want to completely go online.. That can be a lot of change all at once.

Chase has a good reputation and they offer some pretty sweet bonuses if you open an account with a minimum deposit. You can get up to $300 free money by doing this.

Chase Pros

- No minimum deposit to open an account.

- Unlimited electronic deposits

- Earn up to $300 sign up bonus (we love free money!)

- Access 16,000 ATMs

- Online banking and bill-pay and mobile banking

Chase Cons

- $15 monthly fee

- Fee-free cash deposits limited to $5000 per month.

- Fee-free physical transactions limited to 20 per month.

- No free wires included

Novo Small Business Banking

Novo is fairly new on the scene, however, it offers some great benefits. Novo is best known for business banking with freelancers (or small side hustle businesses).

One unique feature is that Novo has integration features with communication apps like Slack and many others. As a business owner, you can easily transfer funds and push updates through these communication channels. This way, your teams can easily see what invoices are due and what payments have been made.

Isn’t technology amazing? Let’s get a better look at the pros and cons of Novo.

Novo Pros

- No monthly fees

- Easy Set up

- Easily transfer funds from your business to personal accounts

- Integration with communication software

- May make check deposits with app

Novo Cons

- Business accounts only

- Electronic checks only (paper check will go through extra steps)

- No cash deposits

- Minimum opening deposit $50

- Credit Check to Open account

Chime Checking

Updated that Chime no longer works with ebay managed payments.

CIT Checking Account

After all of our research, CIT is the business checking account we decided on for our eBay business. There were a few reasons why.

CIT bank offers a small amount of interest to the checking accounts. Even though it’s small, we may as well make some interest as they use our money, right? It’s only fair! They will also reimburse a few of the ATM fees and we could open an account with a very small amount of money.

As we went through all the pros and cons of each one, it seemed as though CIT business account was our best option and so far we’ve been really happy with it.

Let’s take a closer look at what CIT offers.

CIT Pros

- Higher interest rates than traditional banks no matter your balance

- No monthly fees on any accounts

- Remote check deposits

- 24/7 Banking for iOS and Android

- Up to $30 ATM Fee reimbursment

CIT Cons

- $100 initial deposit required

So what is the best bank account for managed payments?

All in all, there are many business checking accounts to choose from, each having their own benefits and disadvantages. The best thing to do is to go through all of the pros and cons of each one mentioned, and decide which one serves your business the best.

CIT works great for us.

So once you pick which card you are going to use – how do you add it to eBay Managed Payments?

That’s a great question. Let’s jump into that.

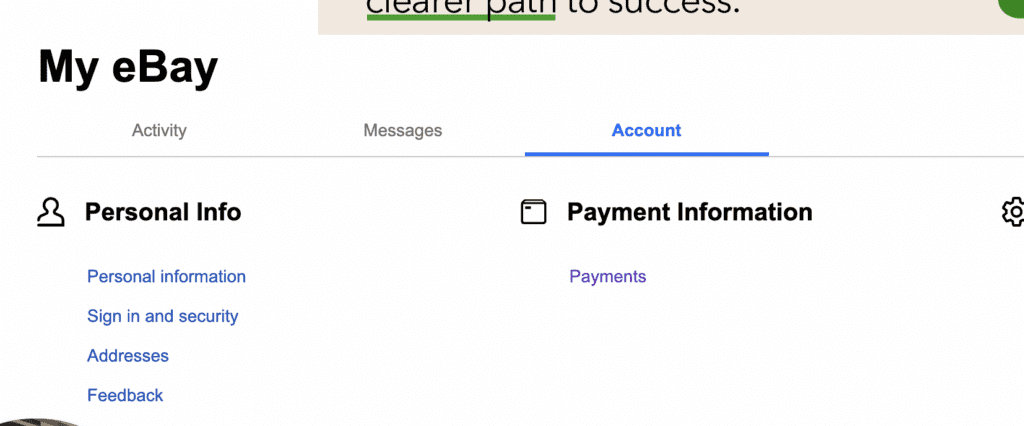

First, login to your eBay account.

Second, Under My eBay find Payment Information and then Payments.

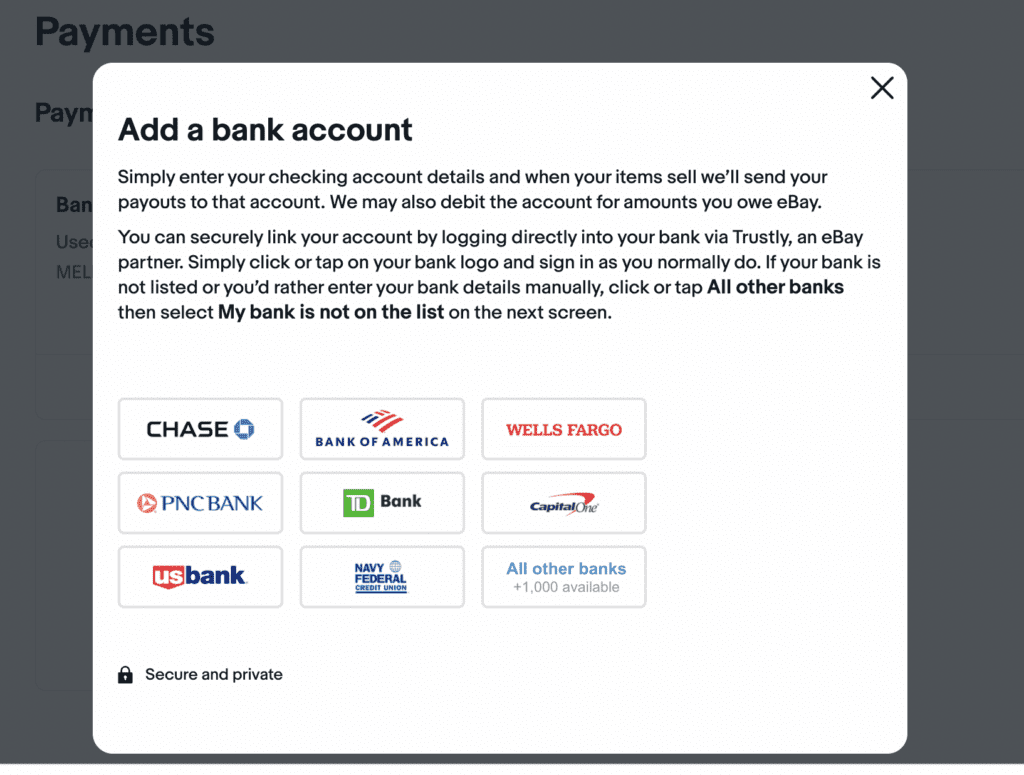

Third, Add your bank account of choice.

If you follow the prompts you will have your account connected in a few minutes.

So Far With Managed Payments

Many people are upset about managed payments, and of course I wasn’t excited about it either! But now that I’ve been using it for a year it’s not terrible. In fact, it’s pretty simple to use and we believe we are saving money on our transactions.

Could it be better?

Yes.

But was PayPal perfect?

Nope.

(A few years ago PayPal held a $25K transaction and planned on holding it for 6 months until I got our state representative involved).

So far I have noticed that my fees have been slightly on the lower side then before, which is good.

My biggest complaint is that they hold the money for 3 days before issuing it to my account.

With my larger items I leave a 5-day shipping window so it’s not that big of a deal, but it would be nice to have access to the funds immediately.

There’s no reason to hold funds once a seller is established and shows they are not a scammer.

But keeping a consistent flow of items getting listed and selling helps with cash flow.

And I don’t think they should charge their fee on the sales tax that we never see, but I view it as a cost of doing business because I definitely don’t want to learn all the sales tax info for each state.

What has been your experience with eBay’s managed payments?

Many people messaged us that they no longer want to use eBay because of it, but I think there is always a workaround.

It’s not as terrible as many people think and it’s definitely not worth quitting the platform (almost all reselling platforms have similar fees and less of a reach of potential customers).

So, have you started using a different online bank account that we didn’t mention? What bank account are you currently using for managed payments? Let us know in the comments below!

FURTHER RESOURCES

Download These 47 Household Items To Resell TODAY!

FREE Workshop How To Turn Your Passion of Flipping Items Into A Profitable Reselling Business

RELATED POSTS

Frustrated With Managed Payments?

which internet bank work for ebay payout?

chime not work anymore.

which is best?

capital one, chase, wellsfargo is easy to suspend account

which bank long lasting and work well?

We’ve been using CIT since managed payments came out and have been happy with it.

Im really confused by this article because ebay requires that the bank NOT be an online bank but a brick and mortar bank. Have they changed? After 25 years I stopped business selling on ebay because of managed payments but want to use it to clear out attic items and then be done. Im out here tonite searching for whatever is deemed the appropriate bank. One problem is meeting the banks limits on transaction and this is an issue because managed payments allows ebay to take from the account whenever it wants to with no care for your limits.

Hi Charles, To our knowledge they do not require a brick and mortar bank. We currently use CIT and have been happy with it. Only our ebay transactions go through that account so they can only take from that account.

Why not open a second account at the same institution you use for your personal account?

You definitely could! We currently have Wells Fargo and didn’t want to open another account with them. We are in the market for a new bank.