Paid in full! Something we all would like to hear. We are not big fans of debt, but when we got married Melissa had $15K in student loan debt.

It wasn’t that much, but it was still something we had to be responsible to pay each month, and that cut into our monthly budget.

Two years ago, we were able to pay off Melissa’s student loan. It may have taken 14 years since she acquired it, but let me tell you, the day we paid it off, It was a huge relief to both of us to not have that debt hanging over our heads.

We felt a real sense of freedom not owing anyone money.

So I can’t imagine being in debt $120K for a student loan, but to be honest, that’s not that uncommon.

Today we have an incredible story from one of our course members, Beau, and his wife Brittany, who paid off $120K in student loan debt in just 4.5 years.

You might be wondering how they did it. Well, it was a lot of hard work, and I can’t forget to mention Beau’s shoe flipping gig helped make it a reality.

Let’s hear their story.

Inheriting $120K in Student Loan Debt

When I was a youngster, fresh out of college, I bought and sold musical instruments as a side hustle. I could do a lot of repairs myself and enjoyed it as a hobby.

My biggest profit was over $3,000 on the sale of a single instrument.

The market really slowed down around 2008, and people weren’t really paying the high prices anymore that they had paid in the past.

I kept all the instruments I had and enjoyed them for a long time, but I slowly sold them over the years.

During those years, I mostly spent my time deep in band directing, often working 70-80hrs a week. It was incredibly rewarding work, and if I died today, I know I did well for many kids and people.

When I got married, my wife had over $120K in student loans, so I started flipping random things from garage sales to help get rid of that debt.

I started to become frustrated with my job that was taking every single weekend

It wasn’t just taking a little of my weekend… like working a 17 hour Friday and a 20 hour Saturday over and over.

At that time, I knew there was money out there to be made, but I just couldn’t get to it.

That’s when I discovered that I could swing by thrift stores on weekdays and find shoes that would sell for good money.

I worked hard to increase my knowledge about shoes, and it has really paid off for me.

At first, I just saw shoes everywhere, and they all had no value to me, but as I learned more, I became able to pick out the good ones fairly quickly.

I quickly realized flipping shoes could be my answer to getting out from under the student loan debt.

From Flipping Instruments to Shoes

To date, I primarily sell shoes, although I love selling lots of other things, too. What really lit my fire with shoes was a pair I found at a garage sale for $2 that sold for $650 in under a month.

I had never heard of the brand. Who knew people would spend that much on used shoes. I didn’t know how to clean crocodile skin or even how to tell if it was genuine… so, I started learning as much as I could.

Shoes are great, because they are everywhere. Everybody wears shoes, and most people have shoes that just sit in their closet until they donate them.

For beginners and folks who don’t have space for larger items, they are very easy to store and photograph.

Shoes are simple to pack and ship

I’ve never had a pair get damaged in shipping.

With the right knowledge, sourcing and some practice, it wouldn’t take too long for a motivated beginner to make an extra $500 a month in shoe money by working several hours a week on the side.

I’ve sold a wild variety of shoes, some unique instruments, Scottish bagpipes, Irish bagpipes, empty vintage pistol boxes, pagers, an 1890’s antique mitre saw, and some pumps that a NASA contractor used for testing something… etc!

But I always seem to come back to shoes as my niche.

How Flipping Shoes Helped Us Pay off $120K

Before I met my wife, I had a nice, used Audi A6 with a V8 and a motorcycle. But, like I said, my wife had $120K in student loan debt that we wanted to pay off, since the interest rate was so high.

I know debt doesn’t have feelings or emotions. It’s just money.

But honestly, when you have that kind of debt there are a lot of negative emotions associated with it. That big number gave me some fear since it was more than I owed on my house.

I knew if we got married that the debt couldn’t be used in any arguments, ever. That was off limits. But, it was still something that we had to talk about and not ignore.

There were a lot more emotions attached to the debt for my wife Brittany since it was from her college schooling. Taking on that debt meant my life would change.

Her student loan was a “parent plus” loan that was in her parents’ name, and the interest rate was very high, around 8%. So, we transferred and refinanced the loans into our names and made a decision to tackle it.

Needless to say, I sold both my motorcycle and Audi and bought an old truck and started on our journey to paying off $120K in student loans.

We both realized making the decision to pay it off would mean we would need to change our lifestyle and mindset about money.

I was just getting started with my flipping side hustle. In the beginning, flipping became a way to have extra income while we paid off that debt.

As I started increasing my flipping profits, we would use it for extra payments and to pay extra bills that came along.

Flipping Accelerated Our Debt Snowball

My flipping income started slowly, but as it grew and I got better at flipping, we were able to use it to throw at the loan payments.

When unexpected bills, like medical and house or car repair happened, we could use flipping money to keep the debt payoff going.

I think the best thing the flipping money did for us was just the peace of mind that if something happened, we were going to be okay. If we wanted to travel or heaven forbid, need to, we would be able to do that.

Or, if the darn dog suddenly needed like $5,000 in stomach surgery…we could do that, too..ugh!

All in all, the flipping money was a helpful “force multiplier” for our teaching salaries and was a huge help in paying down the loan so fast.

Flipping Fit My Schedule

One of the great benefits of flipping for me is that I can work on it when I want. Sure, there are definitely times when I grind really hard, wake up early, stay up late, but it’s MY decision, and I like that.

By learning how to flip, I was able to create some serious extra income with the little time I had from my full-time job.

It created money for us that wasn’t included in our budget and it was something I could handle easily with my busy band directing schedule.

There were and are some times where having an inventory to manage and having too many items waiting to get listed can be a drag, along with staying super organized for things like taxes.

I don’t “enjoy” the organizational part of the business like some people do, but with any business, you have to stay on top of it.

How Teamwork Paid Off – Literally

I think it’s important to decide as a couple if you want to pay off your debts, looking closely at how much they will cost you over time, depending on the type and interest rate.

I’m not a financial advisor at all, but I believe everyone needs to decide if they want to pay off their debt ASAP, or maybe you want to travel now, so it might be slower.

Whatever your decision is, I think it’s important to be on the same page with your spouse in any case.

In the beginning, Brittany and I both negotiated the budget and we still do.

That term “budget” can be scary, freeing, or both!

We (mostly my wife, Brittany) brainstormed every known cost we’d have monthly and throughout the year and set that aside every paycheck.

After that, we had to have serious discussions about how much we needed in the emergency fund before aggressively paying off the loans.

I had the house before we married, so I had a good idea about how much a new roof, new A/C, new fence, etc. would cost.

Like any new homeowner, she was not excited about these potential costs! But, we talked and negotiated through everything together.

In fact, we actually did need a new roof and home A/C while paying off the debt! But, together we continued to remain focused.

Making Visual Goals Helps

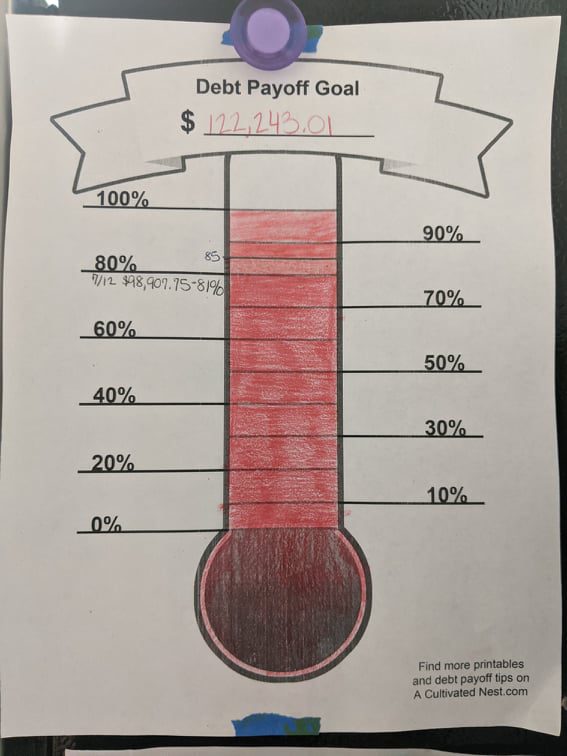

My wife kept a debt chart that looked like a thermometer on the refrigerator. We were really rocking it with big extra payments until our son was born.

Because we already discussed having a family, we pre-planned for those extra costs.

We did not really have a super clear picture about how much good daycare would cost.

So, we maintained the tighter budgeting for longer than expected to get the debt paid off comfortably.

Working together helped us stay in the groove of having no car payments and habitually searching for cheaper rates on everything we needed.

So, I would say that teamwork was our biggest asset and the reason we were able to pay off such a significant amount of debt. We worked at it together.

During those five years of eliminating that huge debt, my flipping gig played a major role in gathering together extra finances for debt payments and unexpected expenses.

My wife would let me know how much we needed, and I would go out and flip shoes and stick to our budget each month.

Rising Above Our Personality Differences

One of the biggest challenges during our debt payoff was making time to take care of the numbers. It’s definitely not comfortable to look at the numbers when you are paying off $120K.

That’s when we decided we’d rather take a hike through a strange, new forest in the daytime than in the darkness.

Thankfully, Brittany’s personality worked better for that, and she took on almost all of that responsibility, and then showed me the numbers after she did the work.

I spent a good amount of time searching for lower bills on things like insurance, utilities, etc.

My wife would get excited about the little milestones we hit along the way, and I would just not. I was in it for the long haul, of course, but I wish I would have been more excited about it for her sake.

My wife would say, “$80,000 paid off!”. But, to me, $80K done meant we had another $40K to go. So, the excitement never really came out in the moment and that’s something I regret.

That personality difference definitely caused some issues between me and my wife.

There were certainly some “strongly worded conversations” about money during that time. But, the funny thing is, I don’t really remember any of them with much detail.

The really important thing that I do remember is that we paid off $120K in debt...together.

Moving Past the Guilt of Debt

I think my wife, Brittany, carries a lot of guilt about bringing that much student loan debt into our marriage.

She says it’s because of the sacrifices I had to make because the debt was from her student loan. But honestly, I don’t feel that way. We both made the sacrifices together.

So when the debt was paid off, she felt a huge weight off of her shoulders. It really has taught both of us how much value we put in things and having things and how we might try to “keep up with the Jones’ (Hello, social media!).

Since going through paying off that much debt we’ve learned a lot

It’s taught us how to buy smart and sell what we don’t use anymore.

We buy used items when we can. It proved to us that we can do hard things together and that we can completely trust God with our finances. In fact, we never stopped tithing/giving throughout our entire debt snowball.

Going through this challenge together, we now know we can take on challenges together. It brings great confidence that we can overcome future struggles with extra work and patience.

Finding a Supportive Community

Like anything, I really believe we are who we hang out with. I felt the same about learning the ins and outs of flipping.

Certainly, I learned a lot by trial and error when I first started flipping, especially with shipping. I wish I would have had a course like Flipper U and a support group back when I first started.

At the time I got into flipping, I was teaching high school band full-time. I didn’t know any flippers, so I was pretty much on my own to learn how to do it by making mistakes and learning from them.

Then, I found Flea Market Flipper from one of my friend’s blogs, Millennial Money Man.

I started to think finding a supportive community might be something to help me learn how to be a better flipper and create more income to help my wife and I pay our debt.

It wasn’t an easy decision by any means

For quite some time, I thought about it before I enrolled in the course. It was especially difficult, because my wife and I were trying to pay off debt and not spend money.

I wanted to learn more about flipping from the experts, Rob and Melissa, but I was also pretty tight with my money!!

There came a point where I was working hard but just spinning my wheels, so to speak. I knew I needed to invest a little back into myself.

It ended up being a no-brainer. I ended up quickly selling a commercial refrigerator that more than paid for the course.

Everybody at my work thought I was pretty much nuts for spending my free time selling on ebay. But my wife and I had a goal to get rid of $120K in student loan debt and I was pretty sure there was some good money to be made with flipping.

….and I was right.

I realized that finding a supportive community is so important. You are never alone when a problem comes up…and problems will pop up!

Sitting at your computer not knowing what to do or how to respond is a terrible feeling, and there are always veterans in the group ready to help.

Anytime somebody finds an item that’s a winner, they share it in the group!

There are no secrets, and everyone is interested in everyone else’s success.

I’ve found this to be very valuable to my business, and it adds a lot of enjoyment to the process. Everyone needs a group of people who understand what you do and to give tons of encouragement and information.

People occasionally ask me, “So why do you still flip items even after you paid off the debt?” That’s a great question. It’s because I absolutely love flipping and can’t imagine not doing it.

It’s been a great side hustle and continues to be

After the Texas freeze and a pipe bursting over my ebay office, we just finally got the insurance company to pay us enough….4 months later.

So, we’ll be doing new floors, maybe kitchen updates, but everything that we like is on backorder, so we’re still waiting.

I did buy a nice, adjustable desk with flipping money, and our next vacation will be paid for with eBay money. I want to get my listing numbers back up to where they were before I lost my office.

Thank God I know how to do that, once we get the house put back together.

Since we paid off $120K in student loan debt, flipping has taken on a whole new role in our family

We are no longer paying off student loans so we now use our flipping profits to have a lot more fun together as a family.

Congratulations Beau and Brittany. We are totally stoked that you have been able to pay off $120K in student loan debt. What seemed impossible, was made into reality thanks to his shoe flipping gig.

What about you? Are you drowning in student loan debt?

Maybe flipping could be a good gig for you too!

We partnered with Beau to bring you a 4 part shoe flipping workshop! He teaches the ins and outs of everything about flipping shoes! In our group we call him the shoe flipping master and once you check out the workshop you will see why.

FURTHER RESOURCES

Download These 47 Household Items To Resell TODAY!

FREE Workshop How To Turn Your Passion of Flipping Items Into A Profitable Reselling Business

RELATED POSTS

How This Grieving Family Paid Off $26K Of Debt From Flipping Items

How This SAHM Makes $1K/Mo Reselling Used Items On eBay

This Retired Couple Made $6,800 Their First 3 Months Of Flipping